- Published by:

- Victorian Independent Remuneration Tribunal

- Date:

- 13 Nov 2025

Message from the Chair

Dear Minister

The main task undertaken by the Tribunal in financial year 2024–25 was a comprehensive review of the remuneration bands for executives employed in prescribed public entities.

In making its Determination, the Tribunal observed changes in the role of public entity executives since its first Determination in December 2020, including the increasing complexity of roles and additional public scrutiny of executives. The Tribunal also commissioned a detailed market analysis that pointed to the reduced competitiveness of the previous remuneration bands, which may affect the ability of the Government to attract and retain talented executives.

Although all of the matters the Tribunal is required to consider under its legislation were weighed carefully, the Tribunal was mindful of the broader impact of its decisions. Thus, particular weight was given to the Government’s Wages Policy and current and projected economic conditions and trends, in seeking to find the right balance between wages fairness for the occupational groups within the Tribunal’s jurisdiction and the need for restraint dictated by the prevailing economic circumstances.

Balancing these factors, the Tribunal decided to maintain the existing remuneration band structure for public entity executives and to continue to align them with the relevant bands in the Victorian Public Service (VPS). The effective increase in the value of the remuneration bands, which took effect on 1 July 2024, was between 4.0 and 4.5 per cent, inclusive of changes to statutory superannuation entitlements.

Due to the timing of the comprehensive determinations of the remuneration bands for VPS and public entity executives, the Tribunal did not make annual adjustments for these groups in 2024–25.

In addition to the determination of remuneration bands for public entity executives, the Tribunal also made annual adjustments to the value of salaries and work-related parliamentary allowances for Members of Parliament (MPs) and allowances payable to local government Mayors, Deputy Mayors and Councillors. MP salaries were increased by 3 per cent and allowances were adjusted to more or less reflect movements in the relevant price index. Similarly, allowances for Mayors, Deputy Mayors and Councillors were increased by 3 per cent.

In response to a request from you, the Tribunal provided advice on any adjustments to the executive motor vehicle scheme that may be necessary to accommodate the provision of zero-emissions vehicles. In summary, the Tribunal advised that executives be given a choice between being provided with an electric vehicle charge card or paying reduced contributions, and that the costing methodology and calculator be updated to reflect these changes.

This financial year was the fourth full year of the operation of the payment above the band process. As you know, if an employer proposes to pay an executive above the maximum of the relevant remuneration band, the employer must first seek and consider the advice of the Tribunal. The employer is not bound to accept the advice. In providing advice, the Tribunal strives to protect the integrity of the overall remuneration structure and at the same time recognise that there may be circumstances where prevailing market conditions justify a departure from the standard structure.

Over the course of the year, the Tribunal provided advice in response to requests from public sector employers to pay a total of 72 executives above the maximum of the relevant band. This represented approximately 2.7 per cent of the total number of executives employed in the Victorian public sector and covered by the Tribunal’s determinations. Thus, it is pleasing to be able to again report that the remuneration bands determined by the Tribunal appear to be appropriate for the vast majority of executives.

Reforms were made to improve the Tribunal’s payment above the band processes including the provision of more timely advice and discontinuing the requirement to seek the Tribunal’s advice for payments above the band where such payments were due solely to the application of the Premier’s annual remuneration adjustment guideline rate. During the course of the coming year, the Tribunal will continue to improve its processes with a focus on providing clearer and case‑specific reasons for its advice.

During the year the Tribunal surveyed MPs, local government Mayors and Deputy Mayors, and public sector employers about their level of satisfaction with the Tribunal’s delivery of its outputs. The overall level of satisfaction was 84 per cent against a target of 80 per cent. It is pleasing to record a significant increase in satisfaction responses from local government compared to the previous survey.

During the year, the Tribunal expanded its engagement with the local government sector, including meeting with elected councillors and council chief executive officers, to explain the Tribunal’s statutory responsibilities and how it goes about its decision-making process. As a result of issues raised during these and other consultations, the Tribunal wrote to the Minister for Local Government proposing that the next comprehensive determination for the sector be brought forward from 2029 to 2026.

Finally, I would like to acknowledge the contribution of Nick Voukelatos who left the Tribunal’s Secretariat in January 2025 to take up a new role in the Department of Treasury and Finance after serving as the inaugural Director of the Tribunal’s Secretariat for over five years. Much of the Tribunal’s administrative and analytical processes and ethos were shaped by Nick. The Members wish him well.

On behalf of the Tribunal’s Members, it is my pleasure to submit this report to you.

Yours sincerely

Warren McCann

Chair

Victorian Independent Remuneration Tribunal

7 October 2025

Abbreviations and glossary

| Abbreviation or term | Definition |

|---|---|

| 2022 LG Determination | Allowance payable to Mayors, Deputy Mayors and Councillors (Victoria) Determination No. 01/2022 |

| 2023 MP Determination | Members of Parliament (Victoria) Determination No. 01/2023 |

| 2024 MP Guidelines | Members of Parliament (Victoria) Guidelines No. 02/2024 |

| 2024 PE Determination | Remuneration bands for executives employed in prescribed public entities (Victoria) Determination No. 01/2024 |

| 2024 PE Guidelines | Victorian Public Entity Executive Remuneration Guidelines |

| 2024 VPS Determination | Remuneration bands for executives employed in public service bodies (Victoria) Determination No. 01/2024 |

| 2025 LG annual adjustment Determination | Allowance payable to Mayors, Deputy Mayors and Councillors (Victoria) Annual Adjustment Determination 2025 |

| 2025 MP annual adjustment Determination | Members of Parliament (Victoria) Annual Adjustment Determination 2025 |

| Council Members | Mayors, Deputy Mayors and Councillors |

| CPI | Consumer Price Index |

| EO&C Budget | Electorate Office and Communications Budget |

| EVP | Employee Value Proposition |

| FMA | Financial Management Act 1994 (Vic) |

| FWC | Fair Work Commission |

| MP | Member of the Parliament of Victoria |

| p.a. | per annum |

| PE | prescribed public entity |

| RATA | remote area travel allowance |

| TRP | total remuneration package |

| VIRTIPS Act | Victorian Independent Remuneration Tribunal and Improving Parliamentary Standards Act 2019 (Vic) |

| VPS | Victorian Public Service |

| Wages Policy | Wages Policy and the Enterprise Bargaining Framework |

| ZEV | Zero-emissions vehicle |

1. About the Tribunal

The Victorian Independent Remuneration Tribunal (Tribunal) provides transparent, accountable and evidence-based decision-making in relation to the remuneration of Members of the Parliament of Victoria (MPs), Victorian public sector executives and local government Mayors, Deputy Mayors and Councillors (collectively, Council Members).

The Tribunal is established under the Victorian Independent Remuneration Tribunal and Improving Parliamentary Standards Act 2019 (Vic) (VIRTIPS Act).

The Minister responsible for the Tribunal at 30 June 2025 was the Minister for Finance. In performing its functions, the Tribunal must act independently and impartially, and is not subject to the control or direction of any person, including the Minister.

1.1 Functions of the Tribunal

The VIRTIPS Act (s. 6(1)) requires the Tribunal to inquire into and make determinations in relation to:

- salaries and work-related parliamentary allowances for MPs

- remuneration bands for executives employed in Victorian Public Service (VPS) bodies

- remuneration bands for executives employed in prescribed public entities (PEs)

- allowances for Council Members.

Amongst other functions, the VIRTIPS Act also provides the Tribunal with powers to:

- make guidelines with respect to the use of particular work-related parliamentary allowances and the Electorate Office and Communications Budget (EO&C Budget) for MPs (VIRTIPS Act, s. 36(1))

- issue guidelines with respect to the placement of public sector executives within the remuneration bands determined by the Tribunal (VIRTIPS Act, ss. 6(1)(e), 6(1)(h) and 36(6))

- advise on proposals to pay executives above the relevant remuneration band set by a determination (VIRTIPS Act, ss. 6(1)(i) and 37(1))

- provide advice to the Minister on any matter relating to the remuneration of any specified occupational group (VIRTIPS Act, s. 6(1)(l)).

1.2 Tribunal Members

The Tribunal consists of up to three Tribunal members.

Warren McCann – Tribunal Chair

Mr McCann has an extensive public service career. As well as serving as Tribunal Chair, Mr McCann is also the Chair of the Judicial Entitlements Panel in Victoria. He was previously a Special Advisor to the Victorian Department of Premier and Cabinet’s Office of Public Sector Executive Remuneration.

His career spans senior appointments in Victoria, South Australia and at the Commonwealth, including as Chief Executive Officer of the South Australian Department of Premier and Cabinet, Commissioner for Public Sector Employment in South Australia and as Secretary of the former Victorian Departments of Justice and Human Services.

Mr McCann is a Fellow of the Australian Institute of Public Administration.

Mr McCann has been a Member of the Tribunal since its inception.

Laurinda Gardner - Tribunal Member

Ms Gardner is a board director, organisational reform and change management consultant, and career coach. She has over 25 years’ senior executive experience and was formerly a Deputy Secretary with the Victorian Department of Treasury and Finance and a Director at the City of Melbourne. Ms Gardner has led large operational teams in diverse areas including strategic and business planning, HR, IT, communications, town planning, stakeholder engagement, finance and risk.

Ms Gardner has performed the role of trusted adviser to several Chief Executive Officers, was an Administrator at the City of Greater Geelong, is currently on the Board of VicTrack, and is a member of several remuneration, and audit and risk committees.

Ms Gardner commenced as a Member of the Tribunal in September 2022.

Greg Wilson - Tribunal Member

Mr Wilson has extensive experience in public policy, governance, and financial management. He is also the Chair of Melbourne Water.

Mr Wilson’s previous roles include Secretary of the Department of Justice and Regulation, Secretary of the Department of Sustainability and Environment, and Deputy Secretary of the Policy and Cabinet Group at the Department of Premier and Cabinet. He also previously served as Chair of the Essential Services Commission, the Country Fire Authority, and Victoria’s State Emergency Service.

Mr Wilson commenced as a Member of the Tribunal in July 2024.

1.3 Annual report requirements

The VIRTIPS Act specifies that the Tribunal is to prepare, as soon as practicable after the end of each financial year (and no later than 31 October), an annual report to the Minister about the following activities in the previous 12 months (VIRTIPS Act, s. 40):

- information about the number of determinations made by the Tribunal

- details of any disclosure of an interest recorded in the minutes of a meeting of the Tribunal under section 14(4) of the VIRTIPS Act

- a review of the operations of the Tribunal, including the work undertaken by the Tribunal

- the number of MPs who have not complied with requests for further information by the Compliance Officer in the preceding year in relation to determinations about separation payments

- the number of appeals heard by the Compliance Officer in the preceding year in relation to separation payments and the outcome of the appeals

- the number of MPs who have not complied with requests for further information by the Compliance Officer in the preceding year in relation to appeals relating to work-related parliamentary allowances and the EO&C Budget

- the number of appeals heard by the Compliance Officer in the preceding year in relation to appeals relating to work-related parliamentary allowances and the EO&C Budget and the outcome of the appeals

- a report on the performance of the function of the Compliance Officer

- any other prescribed matter.

Those matters are addressed in this report.

2. Review of operations

In 2024–25, the Tribunal undertook work on the remuneration arrangements for the following occupational groups:

- MPs

- executives employed in VPS bodies and PEs

- Council Members in local governments in Victoria.

2.1 Members of Parliament

The Tribunal is responsible for inquiring into and setting the value of salaries, work‑related parliamentary allowances, and the EO&C Budget provided to MPs (VIRTIPS Act, ss. 6(1)(a)-(c)). It may also make guidelines with respect to the use of certain work-related parliamentary allowances and the EO&C Budget (VIRTIPS Act, s. 36(1)).

The Determination in effect at 30 June 2025 was the Members of Parliament (Victoria) Determination No. 01/2023 (2023 MP Determination) — the Tribunal’s second comprehensive determination of MP salaries and allowances. The guidelines in force at 30 June 2025 were the Members of Parliament (Victoria) Guidelines No. 02/2024 (2024 MP Guidelines).

2025 Annual Adjustment Determination

The Tribunal is required to make a determination providing for an annual adjustment to the values set in the current MP determination (VIRTIPS Act, s. 18). The Tribunal previously made an annual adjustment determination in July 2024.

On 30 June 2025, the Tribunal made the Members of Parliament (Victoria) Annual Adjustment Determination 2025. This Determination adjusted the values of MP salaries, work-related parliamentary allowances and the EO&C Budget with effect from 1 July 2025.

In making the Determination, the Tribunal was required to consider the Government’s wages policy in operation at that time, the financial position and fiscal strategy of the State, current and projected economic conditions, and any stakeholder submissions (VIRTIPS Act, s. 24(2)).

The Tribunal gave weight to the current Wages Policy and the Enterprise Bargaining Framework (Wages Policy) in light of the current fiscal strategy of the State of Victoria. Stakeholders who had expressed a view on the value of salaries and allowances advised that increases should be limited to either the current or previous Wages Policy.

In its decision, the Tribunal noted available data on economic growth as well as movements in wages and prices. The Tribunal also noted the Fair Work Commission’s (FWC) decision to increase the National Minimum Wage and modern award minimum wages by 3.5 per cent from 1 July 2025. The Tribunal also considered recent remuneration adjustments for MPs in other Australian jurisdictions.

Ultimately, the Tribunal increased the basic salary for MPs, and the additional salary and expense allowance provided to specified parliamentary office holders, by 3 per cent.

From 1 July 2025, the basic salary payable to all MPs is $211,972 per annum, with additional salaries payable to specified parliamentary office holders ranging from $8,479 to $236,525 per annum. The expense allowance payable to eligible specified parliamentary office holders ranges from $3,793 to $64,475 per annum.

The Tribunal also adjusted the values of three work-related parliamentary allowances in line with the latest annual increase in the Australian Bureau of Statistics’ Melbourne Consumer Price Index (CPI) release for the March quarter 2025 (Table 2.1). Noting that the ‘transport’ group of the Melbourne CPI decreased by 1.3 per cent over the twelve months to the March quarter 2025, the Tribunal made no change to the value of the motor vehicle allowance nor the commercial transport allowance.

Table 2.1: Values of work-related parliamentary allowances for MPs, from 1 July 2025

| Allowance type | Change compared to previous year (per cent) | Range or value ($ p.a.) |

|---|---|---|

| Electorate allowance | 2.3 | 47,716 to 57,160 |

| Parliamentary accommodation sitting allowance | 2.3 | 28,201 to 56,401 |

| Motor vehicle allowance | Nil | 24,015 or 36,184 |

| Commercial transport allowance | Nil | 5,372 to 18,507 |

| International travel allowance | 2.3 | 11,410 |

The Tribunal continued to link the international travel allowance to rates set by the Commonwealth Remuneration Tribunal (Australian Government Remuneration Tribunal (2025), Remuneration Tribunal (Members of Parliament) Determination 2024 Compilation No. 4). The Tribunal also adjusted the formula for the EO&C Budget in line with the Melbourne CPI to reflect movements in relevant costs, with the effective rate per voter increasing by 2.3 per cent.

The Tribunal also published the Members of Parliament (Victoria) Guidelines No. 02/2024, which were effective from 13 September 2024. The updated guidelines clarified a small number of permitted uses of the EO&C Budget, including where an MP lodges a freedom of information request for information on an issue that directly impacts their constituency.

Further information about the Determination including a detailed Statement of Reasons, and the current MP Guidelines, is available on the Tribunal’s website.

2.2 Public sector executives

The Tribunal is responsible for inquiring into and determining the remuneration bands for executives employed in VPS bodies and PEs (VIRTIPS Act, ss. 6(d) and 6(g)).

The Tribunal also has the functions of (VIRTIPS Act, ss. 6 and 37):

- issuing guidelines with respect to the placement of executives within the remuneration bands

- providing advice to employers proposing to pay an executive above the relevant remuneration band

- providing advice to the Minister on any other matter relating to the remuneration of executives.

In 2024–25, the Tribunal’s work in relation to executives comprised:

- making a comprehensive determination to reset the values of the remuneration bands for executives employed in VPS bodies (although the bulk of this work was undertaken in 2023–24 and reported in that year’s annual report)

- making a comprehensive determination to reset the values of the remuneration bands for executives employed in PEs

- submitting a report to the Minister on options for updating the executive motor vehicle scheme to provide specific guidance for the provision of zero‑emissions vehicles (ZEVs)

- advice to public sector employers proposing to pay an executive above the relevant remuneration band.

The Tribunal also undertook research into the Employee Value Proposition (EVP) for executives in the Victorian public sector. The EVP project continued into the 2025–26 financial year, with a final report published in September 2025.

2024 comprehensive PE Determination

On 19 December 2024, the Tribunal made its second comprehensive determination for executives employed in PEs — the Remuneration bands for executives employed in prescribed public entities (Victoria) Determination No. 01/2024 (2024 PE Determination).

The Determination provided an opportunity to reset the values of the remuneration bands to reflect current circumstances and, accordingly, the Tribunal set new remuneration bands backdated to be effective from 1 July 2024 for executives employed in PEs.

As required in making the 2024 PE Determination, the Tribunal comprehensively reviewed the roles of executives employed in PEs and the remuneration provided to those executives. It also considered other statutory requirements, including current and projected economic conditions, the State’s fiscal strategy and financial position, Wages Policy and stakeholder views.

In July 2024, the Tribunal published notice of its intention to make the Determination, and invited submissions from affected parties to support the Tribunal’s considerations. The Tribunal received seven submissions, including from PE employers and the Victorian Secretaries’ Board. In October 2024, senior representatives from PEs attended four roundtable meetings held by the Tribunal.

The Tribunal also sought the views of executives employed in PEs via an online questionnaire. Approximately 1,050 executives received the questionnaire, and the Tribunal received 265 completed questionnaires — a response rate of around 25 per cent.

The Tribunal observed changes in these executives’ roles since its first determination, including the increasing complexity of roles and a more challenging operating environment for executives. The Tribunal also considered the relative similarities and differences in the roles of executives employed in PEs and in the VPS.

The fact that executive remuneration in the public sector has fallen behind relevant market benchmarks compared with where it was four years ago supported an increase in the remuneration bands. However, the Tribunal also acknowledged the current financial circumstances of the State and that economic conditions are subdued, and in that context, gave some weight to the Government’s Wages Policy and its own assessment of community expectations.

Balancing these factors, the Tribunal decided to maintain the existing remuneration band structure for PE executives and continued to align the value of the remuneration bands for PE and VPS executives (Table 2.2).

The effective increase in the value of the remuneration bands was between 4.0 and 4.5 per cent, inclusive of changes to statutory superannuation entitlements. The new bands were backdated to be effective from 1 July 2024.

Table 2.2: Values of the remuneration bands, from 1 July 2024

| Classification | Base of band TRP ($ p.a.) | Top of band TRP ($ p.a.) |

|---|---|---|

| Public Entity Senior Executive Service-1/ Senior Executive Service-1 | 225,000 | 290,600 |

| Public Entity Senior Executive Service-2/ Senior Executive Service-2 | 290,601 | 419,000 |

| Public Entity Senior Executive Service-3/ Senior Executive Service-3 | 419,001 | 557,435 |

| Chief executive officer with a work value score below 21 points | 157,158 | 290,600 |

2024 PE executive remuneration guidelines

In the context of the 2024 PE Determination, the Tribunal reviewed and updated its original guidelines and published the Victorian Public Entity Executive Remuneration Guidelines (2024 PE Guidelines) on 19 December 2024.

Stakeholder feedback for the guidelines was similar to that received by the Tribunal for its review of the Victorian Public Service Executive Remuneration Guidelines in 2024.

Changes to the guidelines were intended to encourage employers to:

- consider the appropriateness of the remuneration band as a continuum, when setting the remuneration for a specific position — for example, remuneration above the middle of the band may be appropriate for positions critical to an entity’s operations

- recognise that an executive may undertake additional work beyond the specific responsibilities of their position — for example, a First Nations executive may provide broader cultural leadership

- regularly review executive remuneration to account for maintenance of relativities and evolving market conditions.

Further information about the 2024 PE Determination, including a detailed Statement of Reasons, and the current 2024 PE Guidelines, is available on the Tribunal’s website.

Advice on executive motor vehicle scheme updates and zero‑emissions vehicles

The Minister may request that the Tribunal provide advice about remuneration and funding in relation to any specified occupational group, and remuneration in relation to prescribed public sector bodies (VIRTIPS Act s. 37(3)).

In June 2024, the Minister requested the Tribunal’s advice on updates to the executive motor vehicle scheme to provide specific guidance in relation to the provision of ZEVs.

The Minister requested advice on options for updating the scheme and associated policies, including on matters such as reimbursement or allowances for ZEV charging costs. In providing its advice, the Tribunal was asked to outline:

- any necessary changes to the vehicle costing methodology

- the implications for an executive’s remuneration, compared to the current scheme

- the estimated total cost to employers, with any necessary assumptions noted.

Under the executive motor vehicle scheme, VPS executives may access a motor vehicle for business and private use in return for making contributions towards the cost of their private use of the vehicle from their pre-tax income (Victorian Public Sector Commission (2022), VPS Executive Employment Handbook).

In its approach to providing its advice, the Tribunal considered:

- the current vehicle costing methodology outlined in the VPS Executive Employment Handbook

- the objectives of the current policy

- policies and practices in Victorian departments and other Australian jurisdictions

- broader ZEV policy objectives

- relevant taxation arrangements.

The Tribunal’s advice was provided in November 2024, within six months of the date of the request from the Minister. At the time of finalising this annual report, the Government was considering the Tribunal’s advice.

Public sector Employee Value Proposition review

From time to time the Tribunal may undertake ‘own motion’ reviews and analysis of public sector remuneration trends in relation to any specified occupational group (VIRTIPS Act ss. 6(1)(k) and 6(1)(m)).

In 2024, the Tribunal commenced a research project examining the EVP of executive roles in the Victorian public sector. For the purposes of this project, EVP has been defined as ‘the monetary and non-monetary factors associated with a job that are taken into account by employees when deciding whether to accept or stay in a job’.

The Tribunal considered that understanding the EVP of executive roles is critical to maintaining a high performing Victorian public sector. This includes informing the Tribunal’s work in setting remuneration bands, and when advising on proposals to pay an executive above the band. The Tribunal also expects that its findings will assist public sector organisations to optimise employment offers, and to attract, retain and motivate executives.

In its approach, the Tribunal examined:

- how executives value working in the public sector

- how those job preferences inform remuneration practices

- how individuals value particular employment conditions — for example, flexible work.

The project involved reviewing previous research on EVP and a survey targeted at current and potential public sector executives. The Tribunal published the EVP report, including its findings, in September 2025.

Payment above the band advice

The Tribunal is required to provide advice to public sector employers proposing to pay an executive above the maximum of the relevant remuneration band set by a Determination (VIRTIPS Act, s. 37(1)). Where appropriate, this advice is published on the Tribunal’s website to support greater transparency and accountability on executive remuneration.

In 2024–25, the Tribunal provided advice in response to 41 requests from employers to pay a total of 72 executives above the maximum of the relevant remuneration band (Table 2.3). This compares to 40 requests for advice in respect of 60 executives received in 2023–24.

Table 2.3: Requests for payment above the band advice, by employer type, 2024–25

| Employer type | Number of requests | Number of executives |

|---|---|---|

| Victorian Public Service | 11 | 22 |

| Prescribed public entity | 30 | 50 |

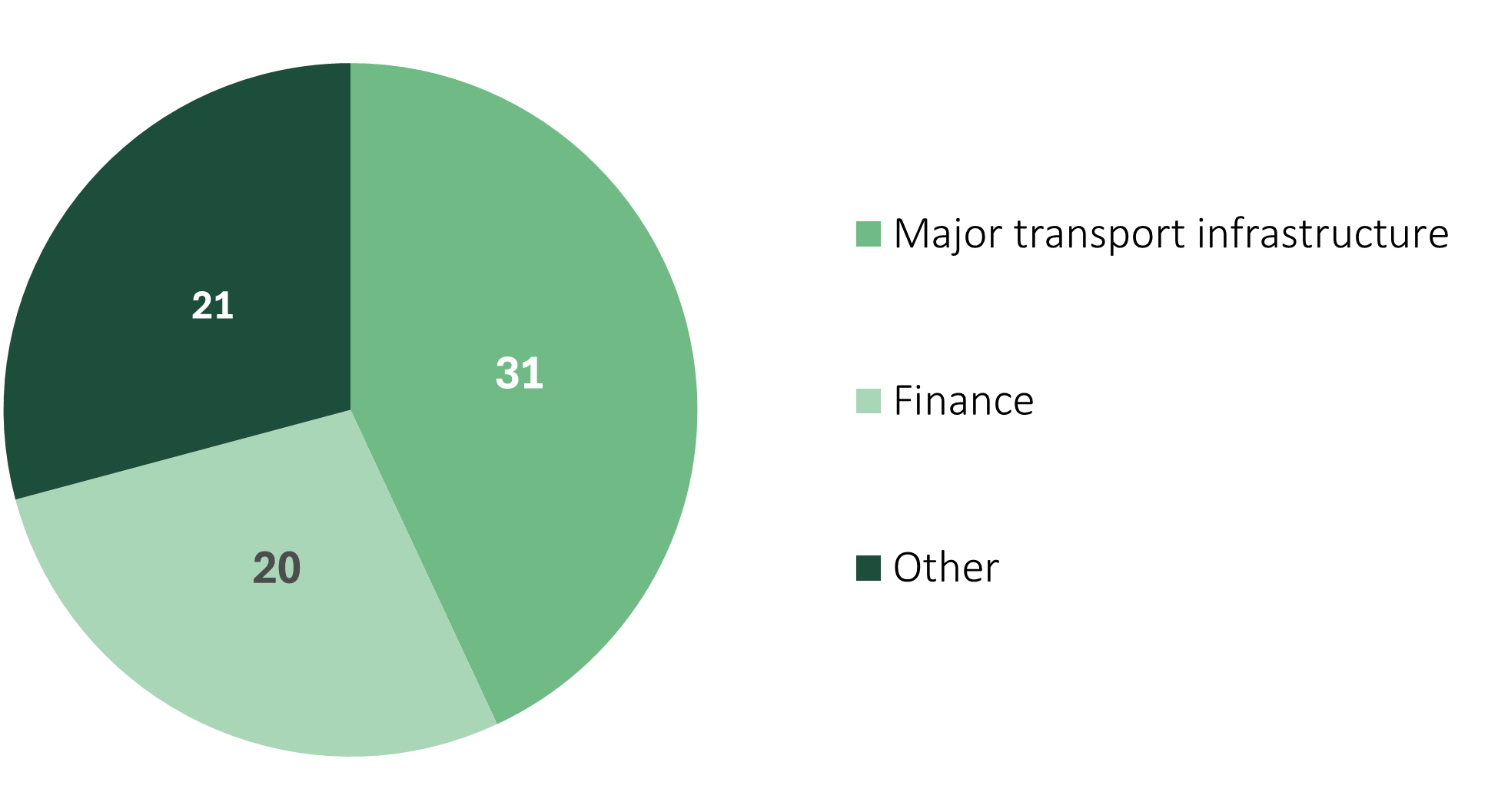

Requests for advice were received from employers across a range of sectors in 2024–25 (Figure 2.1). The number of requests from employers in the major transport infrastructure sector was broadly the same as in 2023–24, while there was a lower number of requests from employers in the finance sector. The ‘other’ sector comprises a range of Government departments and PEs.

Figure 2.1: Requests for payment above the band advice by sector, 2024–25

In May 2025, the Tribunal discontinued the requirement for public sector employers to seek the Tribunal’s advice each time that they wish to increase the remuneration of an executive paid above the band by up to the Premier’s annual remuneration adjustment guideline rate.

It is the Tribunal’s expectation that this will streamline the arrangements for both the Tribunal and public sector employers, while maintaining accountability and transparency in public sector executive remuneration. As a result, the Tribunal anticipates receiving fewer requests for advice in the 2025–26 financial year.

2.3 Mayors, Deputy Mayors and Councillors

The Tribunal is responsible for setting the value of the allowances payable to Council Members in all 79 local governments in Victoria (VIRTIPS Act, s. 23A).

The determination in effect at 30 June 2025 was the Allowance payable to Mayors, Deputy Mayors and Councillors (Victoria) Determination No. 01/2022 (2022 LG Determination).

The 2022 LG Determination set a base allowance for each Council Member, the value of which varies according to the role (Mayor, Deputy Mayor or Councillor) and the allowance category to which the Council has been assigned. The 2022 LG Determination also provided for a remote area travel allowance (RATA), which compensates eligible Council Members for the time taken to travel to council meetings or authorised functions.

Building on feedback from determinations, submissions and stakeholder surveys, the Tribunal met with local government chief executives and the Municipal Association of Victoria, as well as conducting consultation with other peak bodies and stakeholders.

This outreach engaged productively with stakeholders, helped to clarify the Tribunal’s role in setting and amending allowances, and assisted the Tribunal to better understand stakeholder views.

2025 Annual Adjustment Determination

The Tribunal is required to make a determination providing for an annual adjustment to the values set in the current local government determination. The Tribunal has previously made annual adjustment determinations in December 2022, June 2023 and July 2024.

On 30 June 2025, the Tribunal made the Allowance payable to Mayors, Deputy Mayors and Councillors (Victoria) Annual Adjustment Determination 2025 (2025 LG annual adjustment Determination) with effect from 1 July 2025.

Stakeholder feedback received by the Tribunal called for substantive increases to Council Member allowances to reflect the scope and complexity of the work, and the time commitment required. The Tribunal considers that an examination of these broader issues is more appropriate in the context of a comprehensive determination. The Tribunal has written to the Minister for Local Government proposing that the next comprehensive determination be undertaken in 2026.

In addition to statutory requirements, the Tribunal considered:

- recent annual remuneration adjustments for Council Members in other Australian jurisdictions

- the Government’s rate cap of 3 per cent in 2025–26 recommended by the Essential Services Commission

- the overall financial performance of local councils

- the FWC’s decision to increase the National Minimum Wage and modern award minimum wages by 3.5 per cent from 1 July 2025.

This Determination adjusted the values of the base allowance by 3 per cent with effect from 1 July 2025 (Table 2.4). The Tribunal also increased the RATA by 3 per cent to $48.90 per day for eligible Council Members, up to a maximum of $6,112.50 per annum.

Table 2.4: Value of the base allowance for Mayors, Deputy Mayors and Councillors, by Council allowance category, from 1 July 2025

| Allowance Category | Mayors | Deputy Mayors | Councillors |

|---|---|---|---|

| Category 1 | 89,323 | 44,661 | 28,110 |

| Category 2 | 115,347 | 57,673 | 35,049 |

| Category 3 | 142,661 | 71,329 | 41,992 |

| Category 4 | 285,324 | 142,662 | 62,988 |

Further information about the 2025 LG annual adjustment Determination, including a detailed Statement of Reasons accompanying the Determination, is available on the Tribunal’s website.

2.4 State Budget performance measures

The Victorian Budget 2024–25 specifies one quality performance measure for the Tribunal (Department of Treasury and Finance (2024), Victorian Budget 2024-25 — 2024-25 Department Performance Statement, p. 148).

The quality measure relates to the satisfaction of key stakeholders — including MPs, public sector employers and Council Members — with the Tribunal’s processes regarding determinations, reviews and advice.

To measure stakeholder satisfaction, a questionnaire was sent to approximately 445 stakeholders, including MPs, public sector employers and local government Mayors and Deputy Mayors. The questionnaire asked respondents to rate their overall satisfaction with the Tribunal’s delivery of its outputs (The question asked was ‘Considering consultation methods, consideration of views and issues, communication of outcomes, and timeliness, how satisfied were you overall with the Tribunal's delivery of determinations, reviews and advice in 2024-25?’).

The Tribunal recorded an overall level of stakeholder satisfaction of 84 per cent against a target of 80 per cent, based on 80 responses to the questionnaire.

3. Other Tribunal matters

3.1 Tribunal meetings

The Tribunal held 25 regular meetings and no special meetings in 2024–25.

Minutes were kept for each meeting. There were eight disclosures of an interest by a Tribunal Member recorded in the minutes of a Tribunal meeting (VIRTIPS Act, ss. 12 and 14(4)).

- On 27 July 2024, Chair McCann advised he had been appointed as Chair of the Judicial Entitlements Panel.

- On 8 August 2024, Member Wilson confirmed his roles as Chair of the Transport Accident Commission and Chair of the Melbourne Water Corporation.

- On 22 August 2024, Member Wilson noted that the Victorian Funds Management Corporation manages investments for the Transport Accident Commission.

- On 3 October 2024, Member Wilson advised that he is undertaking a review into Victorian Government bodies’ engagement with construction companies and construction unions, which involves engagement with the Victorian Infrastructure Delivery Authority.

- On 28 November 2024, Member Gardner informed the Tribunal she had left the Audit Committee of Energy Safe Victoria.

- On 12 December 2024, Member Gardner advised that she would no longer be a member of the Victorian Planning Authority’s board.

- On 15 May 2025, Member Wilson advised that he had been engaged by the Commissioner of Fire Rescue Victoria to provide advice on an ad hoc basis, including on leadership team structure and other organisational matters.

- On 16 June 2025, Member Gardner confirmed out of session that she is on the Remuneration Committee at the Department of Energy, Environment and Climate Action.

3.2 Finance

Section 45 of the Financial Management Act 1994 (Vic) (FMA) requires the Tribunal to prepare a report of operations and financial statements for each financial year. However, in accordance with a determination made by the Minister under section 53(1)(b) of the FMA, the Tribunal’s report of operations and financial statements is consolidated with the annual report of the Department of Treasury and Finance.

Under section 8(3)(d) of the FMA, and Standing Direction 1.5, the Minister for Finance has also exempted the Tribunal from the requirements of the Standing Directions.

While the exemption has been provided on an ongoing basis, it is subject to the Tribunal confirming with the Executive Director, Budget Strategy, Department of Treasury and Finance, prior to the end of May each year, that:

- the Tribunal has established and maintained alternative arrangements to ensure that no aspect of financial governance is compromised

- there has not been any significant change to the Tribunal’s risk profile and functions

- there has not been any key audit finding that might suggest deficiencies in the Tribunal’s financial management and internal control systems.

The Tribunal Chair, as the Accountable Officer for the Tribunal, provided this confirmation for the 2024–25 financial year.

3.3 Freedom of information requests

The Tribunal did not receive any freedom of information requests in 2024–25.

4. Office of the Compliance Officer

The VIRTIPS Act establishes an office of the Compliance Officer, which is attached to the Tribunal and supported by the Tribunal Secretariat (VIRTIPS Act, s. 27).

A report on the performance of the function of the Compliance Officer must be included in the Tribunal’s annual report (VIRTIPS Act, s. 40(h)).

The Compliance Officer’s functions and powers are specified in the VIRTIPS Act and the Parliamentary Salaries, Allowances and Superannuation Act 1968 (Vic) (These functions are performed by the primary Compliance Officer or, if they are not available or otherwise unable to hear an appeal, by the secondary Compliance Officer (VIRTIPS Act, s. 28(4))). The Compliance Officer is responsible for independently hearing and determining appeals from:

- MPs in relation to a decision by the relevant Officer to reject a claim for a work-related parliamentary allowance or the EO&C Budget

- former MPs in relation to a decision made by a Clerk of the Parliament regarding their entitlement to receive the separation payment.

The Compliance Officer (VIRTIPS Act, ss. 28 and 35):

- is not subject to the direction or control of any person, including the Minister

- is not bound by the rules of evidence

- must conduct proceedings expeditiously, and with as little formality as considered appropriate

- may publish a statement of findings, and any required actions, on the Tribunal’s website, which is absolutely privileged.

4.1 Compliance Officers

Peter Lewinsky AM

Mr Lewinsky is the primary Compliance Officer, appointed to the role on 16 March 2022 for a period of five years.

Mr Lewinsky is an experienced Board and Audit Committee chair and member with a broad portfolio over 25 years covering private and ASX-listed companies and the government sector in a wide range of business areas and professional disciplines. He has extensive experience in financial management, internal and external audit, risk and compliance, governance, strategic decision making and the provision of advice to Board Chairs, Department Secretaries and leaders of a range of organisations.

Mr Lewinsky is a Fellow of the Institute of Chartered Accountants in Australia and New Zealand and a Fellow of the Australian Institute of Company Directors. He has a Bachelor of Economics (Monash University) with an accounting major and a Master of Business Administration degree (University of Melbourne) with a major in finance.

Jane Brockington

Ms Brockington was appointed to the role of secondary Compliance Officer on 10 June 2020.

Ms Brockington has more than 20 years’ experience in public administration working with boards, governance bodies and executive teams. She is Principal of the consultancy Bridging Policy and Practice and has led independent reviews for government. Ms Brockington holds several non-executive director positions and is a fellow of the Institute of Public Administration Australia (Victoria), the Australia and New Zealand School of Government and Leadership Victoria.

Ms Brockington completed her term on 9 June 2025. The VIRTIPS Act specifies that a Compliance Officer is appointed for no longer than five years, and is not eligible for reappointment (VIRTIPS Act, ss. 31(1) - 31(2)).

4.2 Report on the function of the Compliance Officer

Along with a report on the function of the Compliance Officer, the Tribunal’s annual report is required to contain details of specific information sought, and appeals heard by the Compliance Officer. These details are summarised in Table 4.1.

The Compliance Officer (either primary or secondary) did not hear any appeals in 2024–25.

Table 4.1: Details of specific aspects of the Compliance Officer’s activities in 2024–25

| Function - Separation payment | Number |

|---|---|

VIRTIPS Act, s. 40(d) Number of MPs who have not complied with requests for further information by the Compliance Officer in relation to determinations about separation payments | 0 |

VIRTIPS Act, s. 40(e) Number of appeals heard in relation to separation payments | 0 |

| Function - Work-related parliamentary allowances and the EO&C Budget | Number |

|---|---|

VIRTIPS Act, s. 40(f) Number of MPs who have not complied with requests for further information in relation to appeals relating to work-related parliamentary allowances and the EO&C Budget | 0 |

VIRTIPS Act, s. 40(g) Number of appeals heard in relation to work-related parliamentary allowances and the EO&C Budget | 0 |