In 2024–25, the Tribunal undertook work on the remuneration arrangements for the following occupational groups:

- MPs

- executives employed in VPS bodies and PEs

- Council Members in local governments in Victoria.

2.1 Members of Parliament

The Tribunal is responsible for inquiring into and setting the value of salaries, work‑related parliamentary allowances, and the EO&C Budget provided to MPs (VIRTIPS Act, ss. 6(1)(a)-(c)). It may also make guidelines with respect to the use of certain work-related parliamentary allowances and the EO&C Budget (VIRTIPS Act, s. 36(1)).

The Determination in effect at 30 June 2025 was the Members of Parliament (Victoria) Determination No. 01/2023 (2023 MP Determination) — the Tribunal’s second comprehensive determination of MP salaries and allowances. The guidelines in force at 30 June 2025 were the Members of Parliament (Victoria) Guidelines No. 02/2024 (2024 MP Guidelines).

2025 Annual Adjustment Determination

The Tribunal is required to make a determination providing for an annual adjustment to the values set in the current MP determination (VIRTIPS Act, s. 18). The Tribunal previously made an annual adjustment determination in July 2024.

On 30 June 2025, the Tribunal made the Members of Parliament (Victoria) Annual Adjustment Determination 2025. This Determination adjusted the values of MP salaries, work-related parliamentary allowances and the EO&C Budget with effect from 1 July 2025.

In making the Determination, the Tribunal was required to consider the Government’s wages policy in operation at that time, the financial position and fiscal strategy of the State, current and projected economic conditions, and any stakeholder submissions (VIRTIPS Act, s. 24(2)).

The Tribunal gave weight to the current Wages Policy and the Enterprise Bargaining Framework (Wages Policy) in light of the current fiscal strategy of the State of Victoria. Stakeholders who had expressed a view on the value of salaries and allowances advised that increases should be limited to either the current or previous Wages Policy.

In its decision, the Tribunal noted available data on economic growth as well as movements in wages and prices. The Tribunal also noted the Fair Work Commission’s (FWC) decision to increase the National Minimum Wage and modern award minimum wages by 3.5 per cent from 1 July 2025. The Tribunal also considered recent remuneration adjustments for MPs in other Australian jurisdictions.

Ultimately, the Tribunal increased the basic salary for MPs, and the additional salary and expense allowance provided to specified parliamentary office holders, by 3 per cent.

From 1 July 2025, the basic salary payable to all MPs is $211,972 per annum, with additional salaries payable to specified parliamentary office holders ranging from $8,479 to $236,525 per annum. The expense allowance payable to eligible specified parliamentary office holders ranges from $3,793 to $64,475 per annum.

The Tribunal also adjusted the values of three work-related parliamentary allowances in line with the latest annual increase in the Australian Bureau of Statistics’ Melbourne Consumer Price Index (CPI) release for the March quarter 2025 (Table 2.1). Noting that the ‘transport’ group of the Melbourne CPI decreased by 1.3 per cent over the twelve months to the March quarter 2025, the Tribunal made no change to the value of the motor vehicle allowance nor the commercial transport allowance.

Table 2.1: Values of work-related parliamentary allowances for MPs, from 1 July 2025

| Allowance type | Change compared to previous year (per cent) | Range or value ($ p.a.) |

|---|---|---|

| Electorate allowance | 2.3 | 47,716 to 57,160 |

| Parliamentary accommodation sitting allowance | 2.3 | 28,201 to 56,401 |

| Motor vehicle allowance | Nil | 24,015 or 36,184 |

| Commercial transport allowance | Nil | 5,372 to 18,507 |

| International travel allowance | 2.3 | 11,410 |

The Tribunal continued to link the international travel allowance to rates set by the Commonwealth Remuneration Tribunal (Australian Government Remuneration Tribunal (2025), Remuneration Tribunal (Members of Parliament) Determination 2024 Compilation No. 4). The Tribunal also adjusted the formula for the EO&C Budget in line with the Melbourne CPI to reflect movements in relevant costs, with the effective rate per voter increasing by 2.3 per cent.

The Tribunal also published the Members of Parliament (Victoria) Guidelines No. 02/2024, which were effective from 13 September 2024. The updated guidelines clarified a small number of permitted uses of the EO&C Budget, including where an MP lodges a freedom of information request for information on an issue that directly impacts their constituency.

Further information about the Determination including a detailed Statement of Reasons, and the current MP Guidelines, is available on the Tribunal’s website.

2.2 Public sector executives

The Tribunal is responsible for inquiring into and determining the remuneration bands for executives employed in VPS bodies and PEs (VIRTIPS Act, ss. 6(d) and 6(g)).

The Tribunal also has the functions of (VIRTIPS Act, ss. 6 and 37):

- issuing guidelines with respect to the placement of executives within the remuneration bands

- providing advice to employers proposing to pay an executive above the relevant remuneration band

- providing advice to the Minister on any other matter relating to the remuneration of executives.

In 2024–25, the Tribunal’s work in relation to executives comprised:

- making a comprehensive determination to reset the values of the remuneration bands for executives employed in VPS bodies (although the bulk of this work was undertaken in 2023–24 and reported in that year’s annual report)

- making a comprehensive determination to reset the values of the remuneration bands for executives employed in PEs

- submitting a report to the Minister on options for updating the executive motor vehicle scheme to provide specific guidance for the provision of zero‑emissions vehicles (ZEVs)

- advice to public sector employers proposing to pay an executive above the relevant remuneration band.

The Tribunal also undertook research into the Employee Value Proposition (EVP) for executives in the Victorian public sector. The EVP project continued into the 2025–26 financial year, with a final report published in September 2025.

2024 comprehensive PE Determination

On 19 December 2024, the Tribunal made its second comprehensive determination for executives employed in PEs — the Remuneration bands for executives employed in prescribed public entities (Victoria) Determination No. 01/2024 (2024 PE Determination).

The Determination provided an opportunity to reset the values of the remuneration bands to reflect current circumstances and, accordingly, the Tribunal set new remuneration bands backdated to be effective from 1 July 2024 for executives employed in PEs.

As required in making the 2024 PE Determination, the Tribunal comprehensively reviewed the roles of executives employed in PEs and the remuneration provided to those executives. It also considered other statutory requirements, including current and projected economic conditions, the State’s fiscal strategy and financial position, Wages Policy and stakeholder views.

In July 2024, the Tribunal published notice of its intention to make the Determination, and invited submissions from affected parties to support the Tribunal’s considerations. The Tribunal received seven submissions, including from PE employers and the Victorian Secretaries’ Board. In October 2024, senior representatives from PEs attended four roundtable meetings held by the Tribunal.

The Tribunal also sought the views of executives employed in PEs via an online questionnaire. Approximately 1,050 executives received the questionnaire, and the Tribunal received 265 completed questionnaires — a response rate of around 25 per cent.

The Tribunal observed changes in these executives’ roles since its first determination, including the increasing complexity of roles and a more challenging operating environment for executives. The Tribunal also considered the relative similarities and differences in the roles of executives employed in PEs and in the VPS.

The fact that executive remuneration in the public sector has fallen behind relevant market benchmarks compared with where it was four years ago supported an increase in the remuneration bands. However, the Tribunal also acknowledged the current financial circumstances of the State and that economic conditions are subdued, and in that context, gave some weight to the Government’s Wages Policy and its own assessment of community expectations.

Balancing these factors, the Tribunal decided to maintain the existing remuneration band structure for PE executives and continued to align the value of the remuneration bands for PE and VPS executives (Table 2.2).

The effective increase in the value of the remuneration bands was between 4.0 and 4.5 per cent, inclusive of changes to statutory superannuation entitlements. The new bands were backdated to be effective from 1 July 2024.

Table 2.2: Values of the remuneration bands, from 1 July 2024

| Classification | Base of band TRP ($ p.a.) | Top of band TRP ($ p.a.) |

|---|---|---|

| Public Entity Senior Executive Service-1/ Senior Executive Service-1 | 225,000 | 290,600 |

| Public Entity Senior Executive Service-2/ Senior Executive Service-2 | 290,601 | 419,000 |

| Public Entity Senior Executive Service-3/ Senior Executive Service-3 | 419,001 | 557,435 |

| Chief executive officer with a work value score below 21 points | 157,158 | 290,600 |

2024 PE executive remuneration guidelines

In the context of the 2024 PE Determination, the Tribunal reviewed and updated its original guidelines and published the Victorian Public Entity Executive Remuneration Guidelines (2024 PE Guidelines) on 19 December 2024.

Stakeholder feedback for the guidelines was similar to that received by the Tribunal for its review of the Victorian Public Service Executive Remuneration Guidelines in 2024.

Changes to the guidelines were intended to encourage employers to:

- consider the appropriateness of the remuneration band as a continuum, when setting the remuneration for a specific position — for example, remuneration above the middle of the band may be appropriate for positions critical to an entity’s operations

- recognise that an executive may undertake additional work beyond the specific responsibilities of their position — for example, a First Nations executive may provide broader cultural leadership

- regularly review executive remuneration to account for maintenance of relativities and evolving market conditions.

Further information about the 2024 PE Determination, including a detailed Statement of Reasons, and the current 2024 PE Guidelines, is available on the Tribunal’s website.

Advice on executive motor vehicle scheme updates and zero‑emissions vehicles

The Minister may request that the Tribunal provide advice about remuneration and funding in relation to any specified occupational group, and remuneration in relation to prescribed public sector bodies (VIRTIPS Act s. 37(3)).

In June 2024, the Minister requested the Tribunal’s advice on updates to the executive motor vehicle scheme to provide specific guidance in relation to the provision of ZEVs.

The Minister requested advice on options for updating the scheme and associated policies, including on matters such as reimbursement or allowances for ZEV charging costs. In providing its advice, the Tribunal was asked to outline:

- any necessary changes to the vehicle costing methodology

- the implications for an executive’s remuneration, compared to the current scheme

- the estimated total cost to employers, with any necessary assumptions noted.

Under the executive motor vehicle scheme, VPS executives may access a motor vehicle for business and private use in return for making contributions towards the cost of their private use of the vehicle from their pre-tax income (Victorian Public Sector Commission (2022), VPS Executive Employment Handbook).

In its approach to providing its advice, the Tribunal considered:

- the current vehicle costing methodology outlined in the VPS Executive Employment Handbook

- the objectives of the current policy

- policies and practices in Victorian departments and other Australian jurisdictions

- broader ZEV policy objectives

- relevant taxation arrangements.

The Tribunal’s advice was provided in November 2024, within six months of the date of the request from the Minister. At the time of finalising this annual report, the Government was considering the Tribunal’s advice.

Public sector Employee Value Proposition review

From time to time the Tribunal may undertake ‘own motion’ reviews and analysis of public sector remuneration trends in relation to any specified occupational group (VIRTIPS Act ss. 6(1)(k) and 6(1)(m)).

In 2024, the Tribunal commenced a research project examining the EVP of executive roles in the Victorian public sector. For the purposes of this project, EVP has been defined as ‘the monetary and non-monetary factors associated with a job that are taken into account by employees when deciding whether to accept or stay in a job’.

The Tribunal considered that understanding the EVP of executive roles is critical to maintaining a high performing Victorian public sector. This includes informing the Tribunal’s work in setting remuneration bands, and when advising on proposals to pay an executive above the band. The Tribunal also expects that its findings will assist public sector organisations to optimise employment offers, and to attract, retain and motivate executives.

In its approach, the Tribunal examined:

- how executives value working in the public sector

- how those job preferences inform remuneration practices

- how individuals value particular employment conditions — for example, flexible work.

The project involved reviewing previous research on EVP and a survey targeted at current and potential public sector executives. The Tribunal published the EVP report, including its findings, in September 2025.

Payment above the band advice

The Tribunal is required to provide advice to public sector employers proposing to pay an executive above the maximum of the relevant remuneration band set by a Determination (VIRTIPS Act, s. 37(1)). Where appropriate, this advice is published on the Tribunal’s website to support greater transparency and accountability on executive remuneration.

In 2024–25, the Tribunal provided advice in response to 41 requests from employers to pay a total of 72 executives above the maximum of the relevant remuneration band (Table 2.3). This compares to 40 requests for advice in respect of 60 executives received in 2023–24.

Table 2.3: Requests for payment above the band advice, by employer type, 2024–25

| Employer type | Number of requests | Number of executives |

|---|---|---|

| Victorian Public Service | 11 | 22 |

| Prescribed public entity | 30 | 50 |

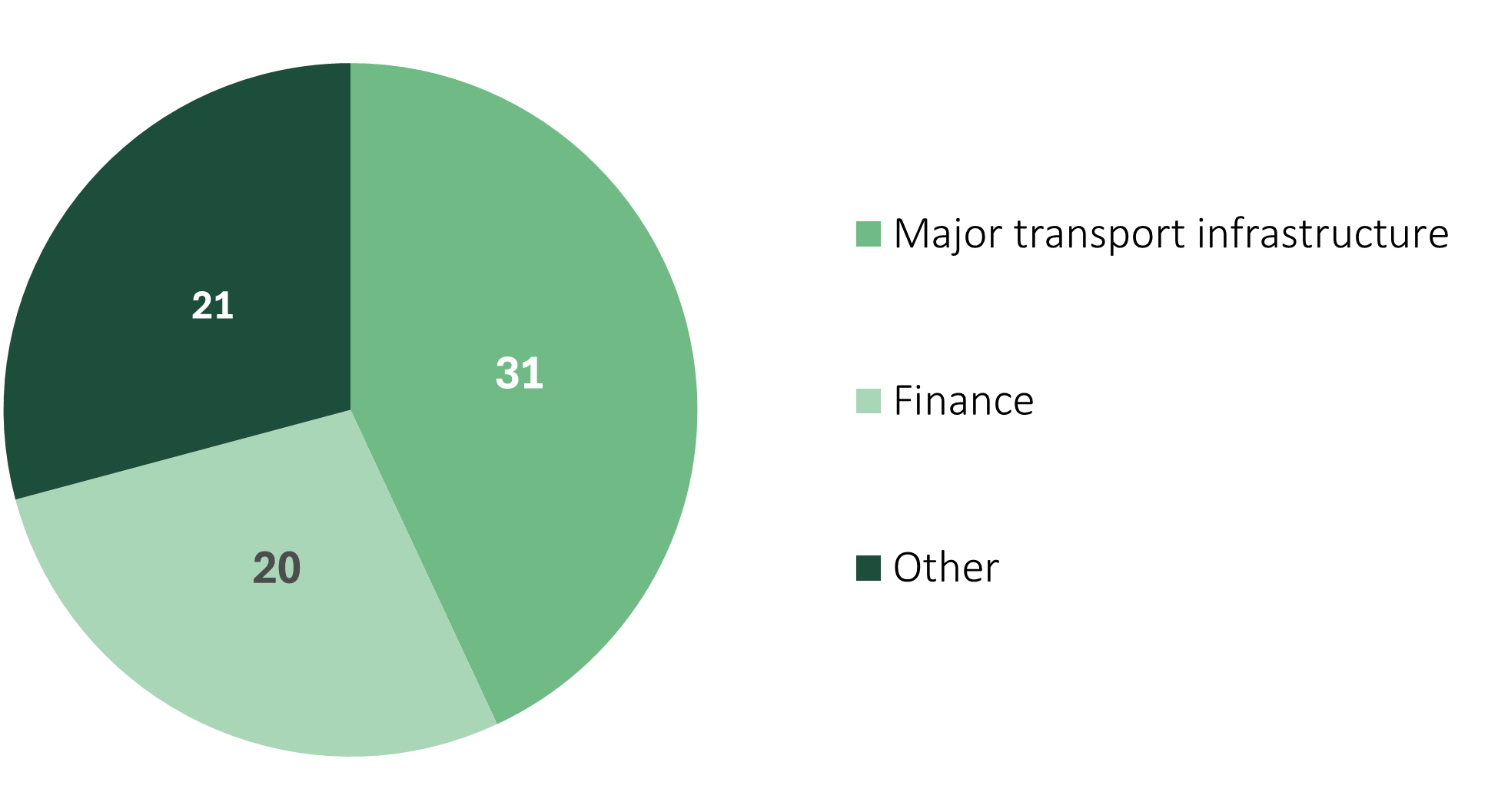

Requests for advice were received from employers across a range of sectors in 2024–25 (Figure 2.1). The number of requests from employers in the major transport infrastructure sector was broadly the same as in 2023–24, while there was a lower number of requests from employers in the finance sector. The ‘other’ sector comprises a range of Government departments and PEs.

Figure 2.1: Requests for payment above the band advice by sector, 2024–25

In May 2025, the Tribunal discontinued the requirement for public sector employers to seek the Tribunal’s advice each time that they wish to increase the remuneration of an executive paid above the band by up to the Premier’s annual remuneration adjustment guideline rate.

It is the Tribunal’s expectation that this will streamline the arrangements for both the Tribunal and public sector employers, while maintaining accountability and transparency in public sector executive remuneration. As a result, the Tribunal anticipates receiving fewer requests for advice in the 2025–26 financial year.

2.3 Mayors, Deputy Mayors and Councillors

The Tribunal is responsible for setting the value of the allowances payable to Council Members in all 79 local governments in Victoria (VIRTIPS Act, s. 23A).

The determination in effect at 30 June 2025 was the Allowance payable to Mayors, Deputy Mayors and Councillors (Victoria) Determination No. 01/2022 (2022 LG Determination).

The 2022 LG Determination set a base allowance for each Council Member, the value of which varies according to the role (Mayor, Deputy Mayor or Councillor) and the allowance category to which the Council has been assigned. The 2022 LG Determination also provided for a remote area travel allowance (RATA), which compensates eligible Council Members for the time taken to travel to council meetings or authorised functions.

Building on feedback from determinations, submissions and stakeholder surveys, the Tribunal met with local government chief executives and the Municipal Association of Victoria, as well as conducting consultation with other peak bodies and stakeholders.

This outreach engaged productively with stakeholders, helped to clarify the Tribunal’s role in setting and amending allowances, and assisted the Tribunal to better understand stakeholder views.

2025 Annual Adjustment Determination

The Tribunal is required to make a determination providing for an annual adjustment to the values set in the current local government determination. The Tribunal has previously made annual adjustment determinations in December 2022, June 2023 and July 2024.

On 30 June 2025, the Tribunal made the Allowance payable to Mayors, Deputy Mayors and Councillors (Victoria) Annual Adjustment Determination 2025 (2025 LG annual adjustment Determination) with effect from 1 July 2025.

Stakeholder feedback received by the Tribunal called for substantive increases to Council Member allowances to reflect the scope and complexity of the work, and the time commitment required. The Tribunal considers that an examination of these broader issues is more appropriate in the context of a comprehensive determination. The Tribunal has written to the Minister for Local Government proposing that the next comprehensive determination be undertaken in 2026.

In addition to statutory requirements, the Tribunal considered:

- recent annual remuneration adjustments for Council Members in other Australian jurisdictions

- the Government’s rate cap of 3 per cent in 2025–26 recommended by the Essential Services Commission

- the overall financial performance of local councils

- the FWC’s decision to increase the National Minimum Wage and modern award minimum wages by 3.5 per cent from 1 July 2025.

This Determination adjusted the values of the base allowance by 3 per cent with effect from 1 July 2025 (Table 2.4). The Tribunal also increased the RATA by 3 per cent to $48.90 per day for eligible Council Members, up to a maximum of $6,112.50 per annum.

Table 2.4: Value of the base allowance for Mayors, Deputy Mayors and Councillors, by Council allowance category, from 1 July 2025

| Allowance Category | Mayors | Deputy Mayors | Councillors |

|---|---|---|---|

| Category 1 | 89,323 | 44,661 | 28,110 |

| Category 2 | 115,347 | 57,673 | 35,049 |

| Category 3 | 142,661 | 71,329 | 41,992 |

| Category 4 | 285,324 | 142,662 | 62,988 |

Further information about the 2025 LG annual adjustment Determination, including a detailed Statement of Reasons accompanying the Determination, is available on the Tribunal’s website.

2.4 State Budget performance measures

The Victorian Budget 2024–25 specifies one quality performance measure for the Tribunal (Department of Treasury and Finance (2024), Victorian Budget 2024-25 — 2024-25 Department Performance Statement, p. 148).

The quality measure relates to the satisfaction of key stakeholders — including MPs, public sector employers and Council Members — with the Tribunal’s processes regarding determinations, reviews and advice.

To measure stakeholder satisfaction, a questionnaire was sent to approximately 445 stakeholders, including MPs, public sector employers and local government Mayors and Deputy Mayors. The questionnaire asked respondents to rate their overall satisfaction with the Tribunal’s delivery of its outputs (The question asked was ‘Considering consultation methods, consideration of views and issues, communication of outcomes, and timeliness, how satisfied were you overall with the Tribunal's delivery of determinations, reviews and advice in 2024-25?’).

The Tribunal recorded an overall level of stakeholder satisfaction of 84 per cent against a target of 80 per cent, based on 80 responses to the questionnaire.

Updated